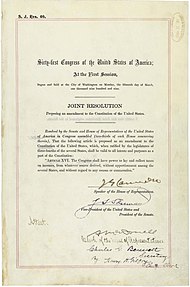

Bí-kok hiàn-hoat tē 16 tiâu siu-chèng-àn

Bí-kok hèn-huat tē-16 tiâu siu-tsìng-àn (ing-gú: Sixteenth Amendment to the United States Constitution) ún-tsún Bí-kok Kok-hōe teh bô àn-tsiàu kok tsiu (U.S. state) pí-lē ê hun-phè, ia̍h-sī khó-lū jîn-kháu phóo-tshâ sòo-kì ê tsîng-hóng tsi hā ti̍t-tsiap tsing-siu sóo-tik-suè (income tax). Pún àn sī uì 1990-nî kok-huē tsiam-tuì Bí-kok tsuè-ko huat-īñ teh 1895-nî ê Pollock sòo Farmers' Loan & Trust Co. àn (Pollock v. Farmers' Loan & Trust Co.) sóo tsò-tshut ê huê-ìng. Tsū-án-ne teh 1909-nî 7-gue̍h 12 thê-tshut tē tsa̍p-la̍k siu-tsìng àn. Koh-tsài teh 1913-nî 2-gue̍h tshe-3 tit-tio̍h ū-kàu sòo-liōng ê tsiu phue-tsún sòo thong-kuè. Koh-lâi, tsiū-án-ne thui-huan Bí-kok tsuè-ko huat-īñ teh 1895-nî ê Pollock àn-kiāñ sóo tsò-tshut ê phuàñ-kuat (Judgment (law)).[1]

Lāi-iông pún-bûn

siu-káiThe Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Kî-thañ iú-kuan suè-siu ê hèn-huat kui-tīng

siu-káiBí-kok hiàn-hoat tē-1 tiâu (Article One of the United States Constitution) tē-2 kuàn (volume (bibliography)) tē-3 tseh:

Representatives and direct taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers...[4]

- I̍k-bûn: tsiòng-gī-guân ê miâ-gia̍h kah ti̍t-tsiap suè ê suè-gia̍h, teh lên-pang pau-kuat kok tsiu tiong, àn-tsiàu kok tsiu ka-kī ê jîn-kháu pí-lē tsìn-hîng hun-phuè.

Tē-1 tiâu tē-8 khuán tē-1 tseh:

The Congress shall have Power to lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States.

- I̍k-bûn: Kok-huē ū-kuân kui-tīng kah tsing-siu ti̍t-tsiap suè, tsìn-kháu suè, suè-kuan kah kî-thañ suè; iōng-lâi hîng kok-tsè, thê-kiong Bí-kok kiōng-tông hông-bū kah kong-kiōng hok-lī, m̄-kù it-tshè ê tsìn-kháu suè, kuan-suè kah kî-thañ suè ìng-kai tsuân-kok thóng-it.

Tē-1 tiâu tē-9 khuán tē-4 tseh:

No Capitation, or other direct, Tax shall be laid, unless in proportion to the Census or Enumeration herein before directed to be taken.

- I̍k-bûn: Tû-liáu kun-kù pún hèn-huat kui-tīng ê jîn-kháu phóo-tsa iá-sī thóng-kè ê pí-lē guā, put-tik tsing-siu jîn-thâu suè iá-sī kî-thañ ti̍t-tsiap suè.

Tsù-kái

siu-kái- ↑ Конституция Соединенных Штатов Америки Исторические источники на русском языке в Интернете (Электронная библиотека Исторического факультета МГУ им. М. В. Ломоносова) (Lō͘-si-ia-gí)

- ↑ 任东来; 陈伟; 白雪峰; Charles J. McClain; Laurene Wu McClain (2004年1月). 美国宪政历程:影响美国的25个司法大案. 中国法制出版社. p. 575. ISBN 7-80182-138-6. (Hàn-gí)

- ↑ 李道揆 (1999). 美国政府和政治(下册). 商务印书馆. pp. 775–799. (Hàn-gí)

- ↑ Knowlton v. Moore 178 U.S. 41 (1900) and Flint v. Stone Tracy Co. 220 U.S. 107 (1911) (Eng-gí)

Tsham-ua̍t

siu-kái- COVID-19 e̍k-biâu (COVID-19 i̍k-biâu; COVID-19 i̍k-tsu; COVID-19 e̍k-chu; poj: e̍k-chu; tsìng-tsu; eng-gí: COVID-19 vaccine)

- Lûntun kim-gîn chhī-tiûⁿ (Lûntun kim-gîn tshī-tiûñ/London bullion market)

- Chicago siong-phín kau-e̍k-só͘ (Chicago siong-phín kau-i̍k-sóo/Chicago Mercantile Exchange)

- Mikhail Khodorkovsky

- Eutelsat 33C (Eutelsat 33C)

Guā-pōo lên-ket

siu-kái- Official Transcript of the 16th Amendment (Eng-gí)

- Sixteenth Amendment and 1913 tax return form Archived 2011-08-15 at the Wayback Machine. (Eng-gí)

- CRS Annotated Constitution: Sixteenth Amendment (Eng-gí)

- Pollock Decision (Eng-gí)

- Brushaber Decision (Eng-gí)

- Stanton Decision (Eng-gí)

- 武汉中院发出全球首个跨国禁诉令,禁止美国公司在全球起诉小米 (Hàn-gí)